Discover Value In Sustainable Finance With ESG Investing Tactics

Many investors seek opportunities that generate profits while creating positive change in the world. ESG investing makes this balance possible by focusing on environmental, social, and governance factors when evaluating companies. This approach highlights businesses that reduce carbon emissions, support fair labor practices, and maintain strong leadership structures. As you explore ESG investing, you discover how to align your financial interests with your values. Companies that prioritize ethical and sustainable practices often stand out for their long-term potential. You can pursue growth while supporting businesses that contribute to a better future, opening doors to investments that matter on multiple levels.

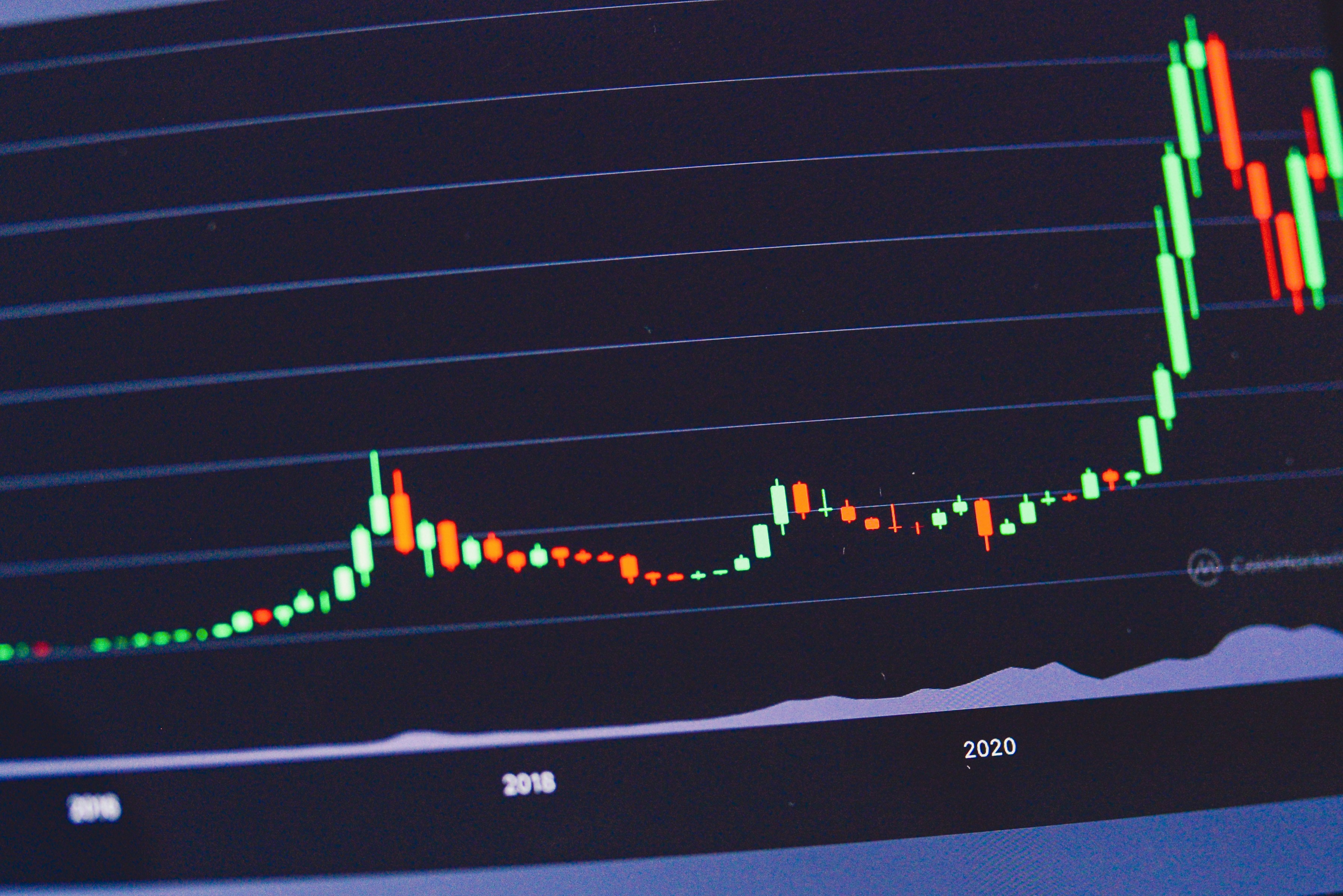

Before you jump in, you need a clear roadmap. You’ll discover how to evaluate metrics, pick the right funds, and manage potential downsides. You’ll also see how investors poured $120 billion into ESG mutual funds in 2022, proving this isn’t a passing trend. With practical tips and examples, you’ll feel ready to make informed choices and find value where you least expect it.

Understanding ESG Investing

ESG investing focuses on three main areas. Environmental criteria cover issues like pollution control and renewable energy use. Social factors look at a company’s relationship with employees, suppliers, and the community. Governance deals with executive pay, shareholder rights, and board structure.

By integrating these factors, you gain more than just a glimpse of past earnings. You gain insights into long-term resilience. Companies that actively manage risks—like supply chain disputes or regulatory fines—often perform better over time. You learn to connect dots between sustainable practices and financial health.

Key Benefits of Sustainable Finance

Sustainable finance goes beyond choosing assets. You direct capital into firms that create positive change on climate goals or social justice. This alignment often results in more stable returns. For example, a 2021 study by *MSCI* showed that ESG leaders experienced lower volatility compared to non-ESG peers.

Another advantage: you might discover fast-growing markets. Clean energy and green technologies are expanding rapidly. The International Energy Agency expects solar capacity to double by 2025. By investing early in solar or wind infrastructure funds, you position yourself ahead of trends that mainstream funds might overlook.

How to Evaluate ESG Metrics

- Data Sources: Check ratings from providers like *Morningstar* or *Sustainalytics*. Compare how they score companies to see if they focus more on controversies or on quantitative measures.

- Score Breakdown: Examine sub-scores for E, S, and G separately. A high overall score might hide weak governance practices or community relations.

- Timeliness: Verify how often a rating updates. Outdated data can mislead if a company recently improved its environmental plan or faced a scandal.

- Third-Party Audits: See if firms undergo external audits for their sustainability reports. Independent checks add credibility.

Don’t assume one metric provides the full picture. Cross-reference ratings with a company’s own sustainability reports and news articles. That way, you catch both documented achievements and any hidden red flags.

Top ESG Investing Strategies

- Negative Screening: Exclude industries like tobacco or fossil fuels. This method ensures your portfolio avoids activities that clash with your values.

- Positive Screening: Pick companies excelling in ESG criteria. You actively seek out top performers in renewable energy or social impact.

- Thematic Investing: Focus on trends like electric vehicle adoption or water conservation. You invest in funds dedicated to those themes, potentially capturing high growth.

- Impact Investing: Allocate capital to projects that deliver measurable social or environmental results. Think investments in affordable housing or clean water initiatives.

- ESG Integration: Incorporate ESG scores into your traditional analysis. You include ratings in valuation models alongside revenue growth and profit margins.

Mixing these methods can help you balance risk and return. For example, you might combine negative screening with thematic investing to avoid coal companies while backing battery technology innovators.

Managing Risks and Expected Returns

No investment comes without risks. Changes in regulations can affect sectors like renewable energy if subsidies shift. Corporate greenwashing also presents dangers—companies might exaggerate their eco-friendly practices.

Set realistic return expectations. ESG funds often closely follow benchmarks, but they sometimes fall behind when traditional sectors rally. You can reduce this gap by choosing funds with flexible mandates that allow higher allocations to small-cap or emerging markets.

Actionable Steps to Begin ESG Investing

- Define Your Values: List three issues that are non-negotiable for you, such as access to clean water or fair labor. Use that list to filter investments.

- Open an Account: Choose a brokerage or robo-advisor that offers dedicated ESG portfolios. Check their fees and minimum investment amounts.

- Research Funds: Compare at least five mutual funds or ETFs. Look for expense ratios under 0.5% and review their performance over three to five years.

- Diversify Holdings: Avoid concentrating on a single sector. Spread your investments across technology, healthcare, and industrials, all with strong ESG profiles.

- Review Quarterly: Set a reminder to revisit ratings and your portfolio mix every three months. Adjust if a company’s ESG score drops significantly.

As you take each step, keep a journal to note why you chose each fund or stock. Tracking your reasons helps you stay objective and improve your approach over time.

ESG investing lets you align financial gains with positive impacts. By analyzing metrics and choosing suitable strategies, you can make informed, purposeful decisions.